Fuel Tax Credits optimised.

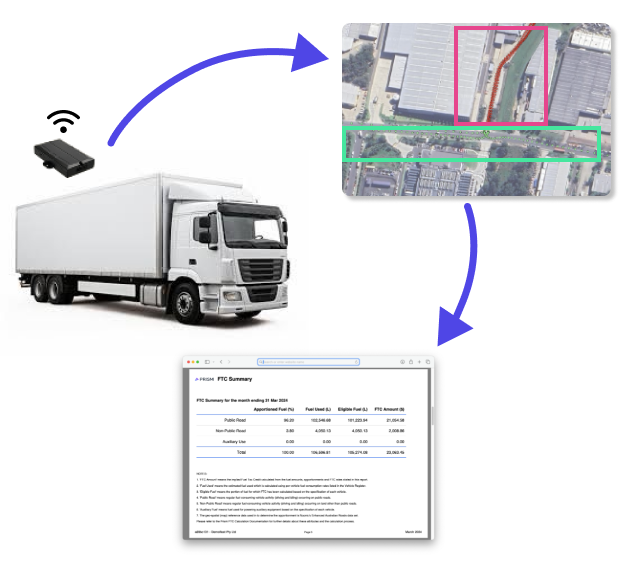

Australia's leading Fuel Tax Credit automation service for commercial vehicles using telematics. Integrates with leading tracking systems and uses precision analysis to generate detailed fuel apportionments.

Save time, maximise claims and keep your process compliant!

Trusted by leading fleet operators

Maximise claim value

Precise identification of all vehicle activity across Australia including depots, ports, access roads and other non-public locations attracting higher FTC rates across your whole fleet with full transparency.

- Precision analysis of each journey point.

- To capture and classify your entire fleet activity.

- Comprehensive national road mapping.

- Continually updated with custom and temporary geofence input options.

- Captures idling and driving.

- Using CAN, accelerometer and other data from your GPS trackers.

Fuel Tax Credits can be a significant factor in fleet finances, with fuel usage off public roads claimable at 49.6c per Litre, representing nearly 25% of typical fuel cost!

Enquire now

Save admin time and manual work

Connects directly with your telematics system to access and analyse vehicle usage data. Cut out risky and costly manual work to prepare your BAS each month.

- Fully automated data access and analysis.

- Focus on understanding and verifying your claims rather than preparing data.

- FTC reports delivered on time every month.

- No more chasing people to complete your claims before the BAS deadline.

- Easy to use platform tools.

- Access all your current and historic data on demand with just a few clicks.

Improve compliance and records

Level up your FTC compliance with comprehensive audit support tools, extensive help centre documentation and an ATO Class Ruling.

- Audit support tools.

- Provides full transparency and details to respond to audit requests and catch errors before submissions.

- Full report history and edit logs.

- A system of record for all vehicle configurations and apportionment results used to support your FTC claims.

- ATO Class Ruling.

- CR 2023/50 provides additional assurance with applicable devices.

Optimise fleet utilisation and management with easy to use dashboards and analytics tools included.

Enquire nowConnects with leading telematics providers

Don't spend days extracting and preparing data each time you do your BAS. If you're with one of our partner providers data access is easy, fast and automated.

Don't see your telematics provider listed? Contact us to discuss options.

For all transport tasks

Fuel Tax Credits are a legislated entitlement for all commercial vehicle operations that can represent a material portion of fuel costs.

- Freight and Logistics

- High productivity heavy freight vehicles can use over 10,000 litres of fuel each month resulting in significant FTC entitlements.

- Bulk Fuel and Liquids Transport

- Tankers utilising pumping equipment may claim higher-rate FTC for auxiliary equipment usage.

- Civil Construction

- All construction sites including public roads that are temporarily closed to the public attract higher-rate FTC.

- Utilities

- Managing dispersed large-scale assets often results in considerable private road and facility vehicle usage.

- Forestry and Agriculture

- Australia has some of the largest agriculture properties in the world with many private access roads and tracks.

- Energy and Mining

- Private access roads for mine and well sites can be as much as several hundred KM long, attracting higher-rate FTC while driving on them

Get more value from your tracking data

Don't leave cash on the table for months, get your Fuel Tax Credits optimised today.

Get more from your asset tracking data

Introducing our new Telematics Integration API

Need to integrate multiple asset tracking systems or selectively share your data with third-parties?

Check our new unified telematics API that solves these problems and much more.

Simplify your fuel data

Introducing the new Nuonic App

Need to automate data extraction from multiple fuel cards?

Get analytics from your fuel usage?

Check out the new Nuonic App that solves these problems and much more.